The mathematics of retirement planning have fundamentally shifted, creating a perfect storm that demands immediate attention from UK-returned Indians planning their golden years in India. Recent data reveals a startling reality: Indians now need ₹3.5 crores ($401,000) just to maintain a comfortable retirement lifestyle—a figure that exposes critical gaps in traditional pension planning approaches.

The Stark Reality: India’s Retirement Corpus Requirements

According to HSBC’s “Affluent Investors Snapshot 2025,” Indians require significantly less retirement capital compared to other major economies, but this lower threshold masks deeper systemic challenges. While Singapore residents need $1.39 million and Americans require $1.57 million, India’s $401,000 requirement reflects not affordability, but rather the harsh reality of lower living standards and healthcare quality that retirees must accept.

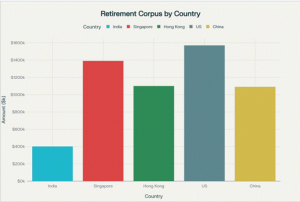

Global Retirement Corpus Comparison:

- India: $401,000 (₹3.5 crores)

- China: $1.09 million (₹9.5 crores)

- Hong Kong: $1.1 million (₹9.6 crores)

- Singapore: $1.39 million (₹12.1 crores)

- United States: $1.57 million (₹13.7 crores)

Retirement corpus requirements vary significantly across countries, with India requiring the lowest amount at $401,000 compared to developed nations.

This disparity highlights a crucial point: UK-returned Indians who have experienced higher living standards abroad may find India’s baseline retirement requirements insufficient for their expectations.

The UK Pension Performance Crisis

The timing couldn’t be worse. UK pension funds experienced their most challenging period in recent history during 2024-2025, with several alarming trends emerging:

Performance Deterioration

- UK pension funds returned -0.65% in Q4 2024, though outperforming their benchmark by 0.57%.

- One-year performance showed 1.20% underperformance against benchmarks.

- Five-year underperformance reached -0.44%, with ten-year figures showing -1.09% underperformance.

- Overall fund values decreased by 0.7% year-on-year.

Inflation’s Double Impact

UK inflation surged to 3.8% by July 2025, up from 2.5% in December 2024—well above the Bank of England’s 2% target. This creates a dual challenge:

- Eroding UK pension values: Real returns turn negative when inflation exceeds investment growth.

- Rising Indian costs: Indian inflation averaging 6-7% annually compounds the retirement corpus requirements.

Currency Volatility Amplifies Losses

Historical currency movements reveal the hidden danger facing UK pension holders:

- GBP vs EUR: 27% decline since 2001

- GBP vs AUD: 23% decline since 2001

- GBP vs NZD: 33% decline since 2001

- GBP vs CHF: 56% decline since 2001

For UK Indians, this means pension contributions made in 2001 would effectively provide less than three-quarters of the planned lifestyle in many international currencies, before accounting for inflation.

The Indian Retirement Preparedness Gap

Research from Grant Thornton’s 2024 pension survey reveals disturbing trends in Indian retirement planning:

Knowledge Deficits

- 50% of Indians remain unaware of the Atal Pension Yojana and its benefits.

- 30% don’t understand how their pension scheme amounts are calculated.

- 69% of UK adults don’t know their current pension value.

- 52% haven’t considered their retirement needs in the past 12 months.

Contribution Inadequacy

- 74% of Indians contribute only 1-15% of income toward retirement.

- 83% rely primarily on EPF, gratuity, and NPS—showing limited diversification.

- 55% expect monthly pensions exceeding ₹1 lakh, but only 11% feel confident about their current savings.

Early Retirement Aspirations vs. Reality

- 43% of under-25s in India target retirement before age 55.

- 56% plan to retire between 55-65 years.

- This contrasts sharply with UK trends where cost-of-living pressures have forced 43% to modify retirement plans.

The QROPS Advantage: Strategic Timing in 2025

Current market conditions create a unique opportunity for UK Indians to optimize their retirement strategy through QROPS transfers:

Market Entry Opportunity

Indian markets are approximately 10% down from 2024 highs, presenting attractive entry points for long-term investors. Combined with India’s recent S&P sovereign rating upgrade from BBB- to BBB (the first in 18 years), conditions favor strategic pension transfers.

Currency Conversion Benefits

The GBP currently trades at favorable levels against the INR, maximizing the conversion value for UK pension transfers to India.

Tax Efficiency Optimization

QROPS transfers allow UK Indians to:

- Avoid the 25% overseas transfer charge when moving to HMRC-approved schemes.

- Benefit from India’s favorable pension taxation under EEE status.

- Optimize withdrawal strategies based on Indian tax brackets rather than UK rates.

The Mathematics of Delayed Action

The cost of inaction compounds exponentially. Consider these scenarios for a 40-year-old UK Indian:

Scenario 1: Immediate QROPS Transfer

- Transfer ₹50 lakhs today at favorable exchange rates.

- Invest in Indian growth markets at current correction levels.

- Benefit from India’s projected 7-8% GDP growth over next 20 years.

Scenario 2: Wait 5 Years

- Miss Indian market recovery cycle.

- Face higher transfer costs due to increased corpus size.

- Navigate potential UK regulatory changes affecting pension transfers.

Strategic Recommendations for UK Indians

1. Immediate Assessment

- Calculate current UK pension values in INR terms.

- Project Indian retirement expenses accounting for healthcare inflation (8-12% annually).

- Assess gap between current trajectory and ₹3.5 crore minimum requirement.

2. QROPS Transfer Evaluation

- Review HMRC-approved schemes in India (currently 33 options available).

- Compare fund management costs between UK and Indian providers.

- Analyze asset allocation opportunities in Indian equity and debt markets.

3. Diversified Investment Strategy

- Maintain global diversification: 60-70% Indian assets, 30-40% international exposure.

- Focus on Indian growth sectors: technology, healthcare, infrastructure.

- Consider inflation-indexed instruments to protect purchasing power.

4. Timeline Optimization

Current conditions favor immediate action:

- Q4 2025 – Q1 2026: Optimal transfer window given market cycles.

- Currency hedging: Lock in favorable GBP-INR rates for phased transfers.

- Market timing: Enter Indian markets during correction phase.

The Urgency of Strategic Action

The convergence of UK pension underperformance, rising inflation, currency volatility, and India’s massive retirement corpus requirements creates an unprecedented challenge for UK Indians. The traditional approach of maintaining UK pensions until retirement no longer serves their best interests.

The window for optimal QROPS transfers is narrowing. With Indian markets presenting attractive entry points, favorable currency conversion rates, and regulatory stability, 2025 represents a critical decision point.

UK Indians who act decisively can transform this crisis into opportunity—securing their retirement in India while benefiting from current market dislocations. Those who delay risk watching their UK pensions erode in real terms while Indian retirement costs continue their relentless climb.

The choice is stark: strategic action today or financial compromise tomorrow. For most UK Indians, the path forward leads through QROPS to India—but only if they act while current conditions remain favorable.

“For personalized QROPS transfer guidance and regulatory compliance support, consult with qualified pension transfer specialists who understand both UK and Indian retirement planning regulations.”

The post The Hidden Retirement Crisis: Why UK Indians Need ₹3.5 Crores to Retire Comfortably in India appeared first on QROPS Direct.

from QROPS Direct https://www.qropsdirect.in/blog/2025/09/12/qrops-transfers-for-uk-indians/

https://www.qropsdirect.in/